E–banking

Perform basic financial transactions 24/7 from anywhere in the world!

Some services are priced lower than in customer service points

24/7 financial transactions from anywhere in the world

Quick and convenient signing of deposit agreements

Access to portals for public electronic services

Access to portals for public electronic services

- Online banking allows you to view your account information, quickly and conveniently transfer money, pay for goods and services and make enquiries to the bank.

- Users of the Internet Bank can view and print their payment confirmation documents and statements for managed accounts.

- You can sign deposit agreements online, start saving for your children’s future and your leisure time. You can always track your savings in the Internet Bank.

Services available to Internet Bank users

-side_image.jpg)

Mobile banking application

It doesn’t get any more convenient than this – manage your finances from your smartphone!

- Quick account overview

- Convenient payments here and now

- Currency exchange on the account

- Correspondence with the bank.

Log-in tools

Mobile-ID

Securely and conveniently verify your identity with Mobile-ID!

How do I subscribe to the service?

For a SIM card with a Mobile-ID certificate, please contact your mobile operator, who will issue you with a certified SIM card and help you activate the Mobile-ID service for successful use.

Smart-ID

A smart authentication tool for free and convenient access to e-services.

You can find our free mobile application on:

How do I start using the service?

Download the Smart-ID application from Google play (Android) or App Store (iOS) and create a Smart-ID account using your preferred method of identification.

Types of Smart-ID accounts:

- Smart-ID Basic: once you have created an account through the Urbo Internet Bank, you can use your Smart-ID for e-banking with any bank.

- Smart-ID: once you have created an account with Mobile-ID or an ID card, Smart-ID can be used for all e-services integrated into the Smart-ID network (not just e-banking).

Important! If you are accessing your online bank or mobile banking application for the first time with Smart-ID and you are using a Basic account created with another bank, you will need to authorise yourself by other means (Mobile-ID or SMS code) and tick the Smart-ID Basic consent box in your online bank settings.

SMS code

A log-in tool to conveniently confirm payment transactions.

How do I start using the service ?

- To start using the SMS code service using your existing identification means, log in to the Internet Bank and select “Settings” -> “Mobile-ID”, “SMART-ID”, “SMS code”. At the bottom of the page, tick the box to agree to use the SMS code log-in tool and save your information.

- When accessing your online bank or mobile application, select the SMS code log-in method, enter your User ID and password (you will need to change your password the first time you log in with an SMS code) and click “Next”. If the details are correct, you will receive a unique 6-character code via SMS, which you can enter in the SMS code field and click “Next”.

Important! With the SMS code log-in tool enabled, you will need to change your password for your online bank or mobile banking application at least every 90 days. This should be done in accordance with the bank’s recommended security tips.

Other services

Notification Centre

Notifications in real time.

The Notification Centre is a service provided by the bank that allows you to receive information about changes in your account balance, card transactions or messages sent by the bank. Receive information directly through the mobile app, via SMS or by e-mail.

Notifications are for informational purposes only and do not confirm the execution of a transaction in the account. Confirmation of the transaction execution is provided in the account statement.

You can choose the condition after which notifications will be sent to you:

- When an amount higher than the one you have chosen is credited to the account;

- When the account is debited with an amount higher than the amount you have chosen.

Frequently asked questions

You can find transaction limits that apply to your accounts in the Online Account Management Agreement or the Internet Bank (go to Settings -> Transaction limits). You can also find out the applicable limits by visiting your nearest bank branch.

You can change the transaction limits in the Internet Bank or via the mobile banking app. It is important to remember that due to the potential risk of fraud and the security of your funds, you can set the following maximum limits for payment transactions in the Internet Bank or mobile banking app:

- Single payment transaction limit – EUR 200,000;

- Daily payment transaction limit – EUR 200,000;

- Monthly payment transaction limit – EUR 2,000,000.

The limits changed in the Internet Bank or mobile banking app will not take effect until the following day. If you need transaction limits above the maximum or want them to take effect immediately, please visit your nearest branch.

If you are logging in with Smart-ID:

- Check that you have entered the correct User ID. You can find your User ID in your Agreement of Account Management by Internet.

- Make sure you enter the correct national ID number in the national ID number field. If you don’t have a national ID number, you can see the identification number you need to enter in the national ID number field in the Smart-ID app.

If you are logging in with Mobile-ID:

- Check that you have entered the correct User ID. You can find your User ID in your Online Account Management Agreement.

- Make sure you are using the correct telephone number and that the mobile signature service is provided to the telephone number you have provided.

- If you don’t remember your sPIN1 and sPIN2 codes, or if you have blocked them, you can find information on your mobile operator’s (Telia, Tele2, Bitė, Teledema) website.

If you are logging in with an SMS code:

- Check that you have entered the correct User ID. You can find your User ID in your Online Account Management Agreement.

- Make sure you have entered the correct password.

- If you enter incorrect details 4 times in a row, the system will automatically block you for a period of 30 minutes; if you enter incorrect details 8 times, your access to the Internet Bank will be permanently blocked.

- If you can’t remember your password, you can always try another means of logging in, such as Smart-ID or Mobile-ID.

If your access is temporarily blocked:

If you see the message: “Your access is temporarily blocked. Try again after XXX minutes”, it will be unblocked automatically after 30 minutes. Wait for the specified amount of time and try to log in again.

While you’re waiting:

- Make sure that you have the correct User ID. You can find your User ID in your Online Account Management Agreement.

- If you are logging in with an SMS code, please try to remember your password. If you can’t remember your password, try another means of logging in, such as Smart-ID or Mobile-ID.

- Please note that the maximum number of additional attempts (30 minutes apart) is 4. If you exceed the number of additional attempts allowed, your access will be automatically blocked.

If your access has been blocked:

If you see the message: “Your access is blocked.”, please call 19 300 or +370 52644800 (if you are abroad) for unblocking. Our call centre is open on weekdays from 8 a.m. to 5 p.m.

You can also visit your nearest Urbo Bankas branch. Make sure you have your ID card or passport with you.

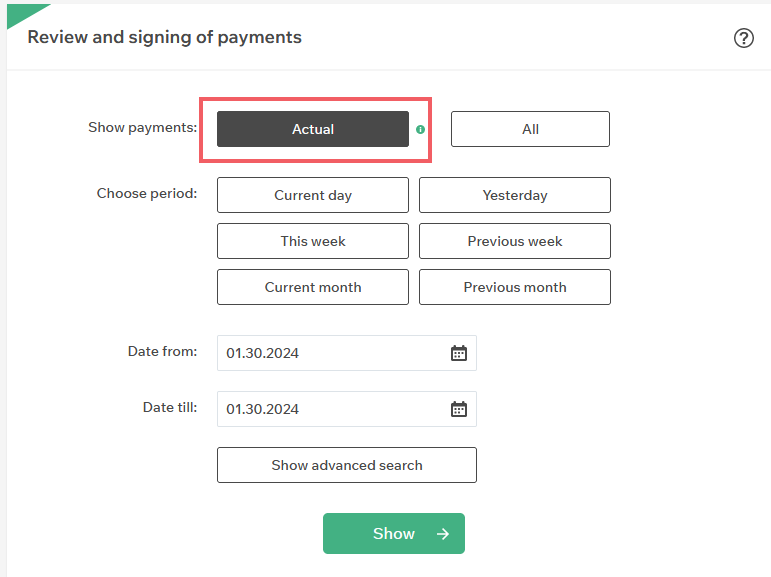

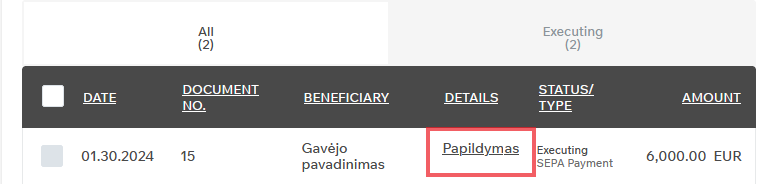

You can cancel pending payments by logging in to the Internet Banking and selecting the menu item Payments -> Payment overview and signing. Once you have found the payment you want to cancel, click on the text in the payment purpose field for that payment.

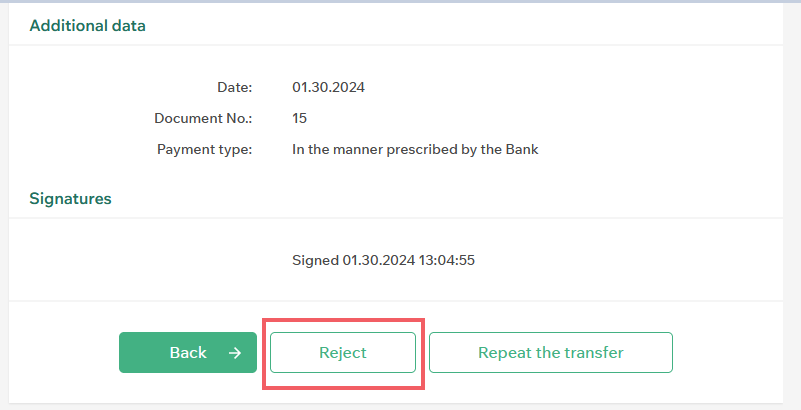

At the bottom of the payment review form that appears, click the Cancel button and confirm the cancellation by clicking the Yes button.

If the payment is successfully cancelled, the message Payment successfully cancelled will be displayed and the payment status will change to Cancelled.

If you notice that your account has not been debited or funds have not reached the recipient’s account, it is possible that your transfer has been rejected for some reason.

You can always check whether a transfer has been rejected and the reason for this by logging in to your Internet Bank, selecting Payments -> Payment overview and signing from the menu, finding the relevant payment and clicking on the text in the payment purpose field for that payment.

The reason for rejecting the payment will be provided at the bottom of the payment review form.

When searching for a transfer in the Payment overview and signing form, please note the available filters. If you choose to show only Current payments, the system will only show you today’s transfers. Select All to see transfers from the previous period.

Security in digital channels

Familiarize yourself with online security risks and our pre-cautionary guidelines

-banner_image.jpg)