Savings

Daily banking

Other services

"Urbo" is a new bank name

Become a customer

Urbo Bank opens accounts in euro and foreign currency for business customers registered in the Republic of Lithuania or abroad.

- Share

You can become an online customer by clicking on the following link - Become a customer .

You will need to identify yourself with a Smart-ID or Mobile-ID, as well as provide photographs of your ID and a selfie. Next, you will have to fill in the Customer Awareness Questionnaire and sign it with an electronic signature.

- We will inform you of the next steps within 1 business day of your application.

- If you have provided all the details when completing your application, you will receive a bank notification regarding the signing of the completed contract documents at the email address you provided when completing your application.

- Once you have signed the contract, you will receive a notification to start using our services.

- We will contact you at the contact details you have provided to give further information in the event of a rejection of your application.

Links

- Share

- Seal of the legal entity (if any).

- Identity document (ID card or passport) of the representative of the legal entity.

- If available, a completed Customer Legal Entity Profile in the form indicated by the bank.

- The original extended extract from the Register of Legal Entities or the access code of the State Enterprise Centre of Registers for obtaining the electronic certified extract of the legal entity.

- An extract from the Information System of Legal Entities Participants (JADIS) of the data on the participants of the legal entity.

- An extract from the sub-system of beneficial owners (JANGIS) on the beneficial owners of the legal entity.

- The document establishing the legal entity (articles of association or other equivalent documents stating the basis on which the legal entity, partnership, institution, association or organisation is established).

- The original copy of the power of attorney of the legal entity, certified by a notary public, if the legal entity is represented by an authorised person instead of a manager. For an example of a power of attorney which you can find in the link section.

The original copy of the power of attorney issued abroad must be certified by an apostille and drawn up in Lithuanian, English or Russian, or in another language, together with a notarised translation into Lithuanian.

- Share

- Seal of the legal entity (if any).

- Identity document (ID card or passport) of the representative of the legal entity;

- If available, a completed Customer Legal Entity Profile in the form indicated by the bank.

- A certificate of registration of the legal entity, or an equivalent document confirming the registration, containing the name of the legal entity, the address of registration, and the registration or other details of the legality of the activity.

- The statutes (regulations and articles of association) of the legal entity and any amendments to these documents.

- Permission from the central bank of the foreign country where the legal entity is registered to open a bank account in another country, if required by the legal acts of the foreign country where the legal entity is registered.

- The decision of the body of the legal entity on the appointment (election) of the manager of the legal entity.

- An original copy of the power of attorney to represent the legal entity, certified by a notary public or other competent official in a foreign country if the bank account agreement is signed by an authorised person.

- An original copy of the power of attorney to represent the legal entity, certified by a notary public or other competent official in a foreign country if the bank account agreement is signed by an authorised person.

- Share

-

Farmers must present their farm registration certificate and stamp (if any).

-

Lawyers must present a certificate of authorisation to practise as a lawyer, a lawyer’s certificate and a stamp (if any).

-

Assistant lawyers must present the decision of the Lithuanian Bar Association on the inclusion of the assistant lawyer in the list of assistant lawyers in Lithuania, the certificate of the assistant lawyer and the stamp (if any).

-

Notaries must present a notary certificate, an order of the Minister of Justice of the Republic of Lithuania on appointment as a notary and a stamp (if any).

-

Bailiffs must present a certificate of the right to practise as a bailiff, a bailiff certificate, an order of the Minister of Justice of the Republic of Lithuania on the appointment as a bailiff, and a stamp (if any).

-

Identity document (ID card or passport).

-

If available, a completed Customer Legal Entity Profile in the form indicated by the bank.

- Share

- Identity document (ID card or passport) of the authorised person;

- The memorandum of association or instrument of incorporation, or, in the case of a partnership, a joint venture agreement;

- The original copy of the power of attorney to open a savings account for the company to be established (unless provided for in the memorandum of association or instrument of incorporation).

- Share

- Transferring money in euro and foreign currency to other bank accounts;

- Making periodic payments to beneficiaries;

- Using the e-invoicing service;

- Accessing credit, leasing and other financing services;

- Getting cash in euro and foreign currency from other banks;

- Depositing cash into your account;

- Withdrawing cash from your account;

- Buying and selling foreign currency;

- Enclosing nominal check;

- Performing other financial transactions.

Managing your bank accounts using internet banking, the bank’s mobile app or by visiting your nearest bank branch.

Links

- Share

E-banking

To download your account statement, select Accounts and Account statement from the menu. Select the account and the period for which you would like to receive an account statement and click the Export button.

Once you have done this, select the format (XML, XLS, CSV or PDF) in which you would like to download your account statement and click the Save button.

- Share

You can find transaction limits that apply to your accounts in the Online Account Management Agreement or the Internet Bank (go to Settings -> Transaction limits). You can also find out the applicable limits by visiting your nearest bank branch.

You can change the transaction limits in the Internet Bank or via the mobile banking app. It is important to remember that due to the potential risk of fraud and the security of your funds, you can set the following maximum limits for payment transactions in the Internet Bank or mobile banking app:

- Single payment transaction limit – EUR 200,000;

- Daily payment transaction limit – EUR 200,000;

- Monthly payment transaction limit – EUR 2,000,000.

The limits changed in the Internet Bank or mobile banking app will not take effect until the following day. If you need transaction limits above the maximum or want them to take effect immediately, please visit your nearest branch.

- Share

To log in to internet bank, please use your User ID (which can be found in the Online Account Agreement) and your usual means of identification: your Smart-ID, Mobile-ID or SMS code.

- Share

If you are logging in with Smart-ID:

- Check that you have entered the correct User ID. You can find your User ID in your Agreement of Account Management by Internet

- Make sure you enter the correct national ID number in the national ID number field. If you don’t have a national ID number, you can see the identification number you need to enter in the national ID number field in the Smart-ID app

If you are logging in with Mobile-ID:

- Check that you have entered the correct User ID. You can find your User ID in your Online Account Management Agreement

- Make sure you are using the correct telephone number and that the mobile signature service is provided to the telephone number you have provided

- If you don’t remember your sPIN1 and sPIN2 codes, or if you have blocked them, you can find information on your mobile operator’s (Telia, Tele2, Bitė, Teledema) website

If you are logging in with an SMS code:

- Check that you have entered the correct User ID. You can find your User ID in your Online Account Management Agreement

- Make sure you have entered the correct password

- If you enter incorrect details 4 times in a row, the system will automatically block you for a period of 30 minutes; if you enter incorrect details 8 times, your access to the Internet Bank will be permanently blocked

- If you can’t remember your password, you can always try another means of logging in, such as Smart-ID or Mobile-ID

- Share

If your access is temporarily blocked:

If you see the message: “Your access is temporarily blocked. Try again after XXX minutes”, it will be unblocked automatically after 30 minutes. Wait for the specified amount of time and try to log in again.

While you’re waiting:

- Make sure that you have the correct User ID. You can find your User ID in your Online Account Management Agreement.

- If you are logging in with an SMS code, please try to remember your password. If you can’t remember your password, try another means of logging in, such as Smart-ID or Mobile-ID.

- Please note that the maximum number of additional attempts (30 minutes apart) is 4. If you exceed the number of additional attempts allowed, your access will be automatically blocked.

If your access has been blocked:

If you see the message: “Your access is blocked.”, please call 19 300 or +370 52644800 (if you are abroad) for unblocking.

Our call centre is open on weekdays from 8 a.m. to 5 p.m.

You can also visit your nearest Urbo Bankas branch. Make sure you have your ID card or passport with you.

- Share

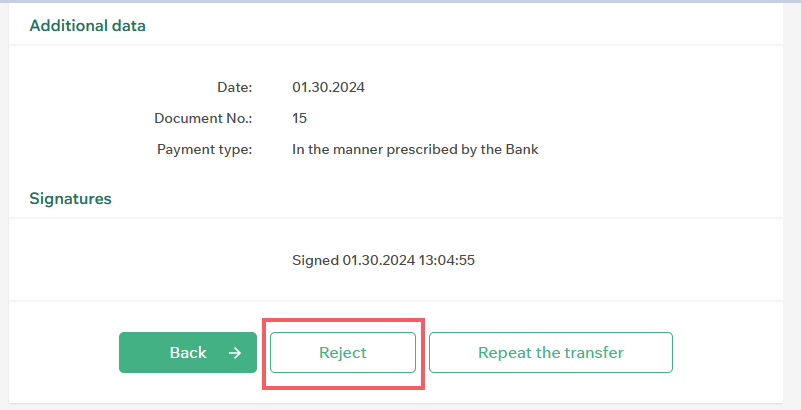

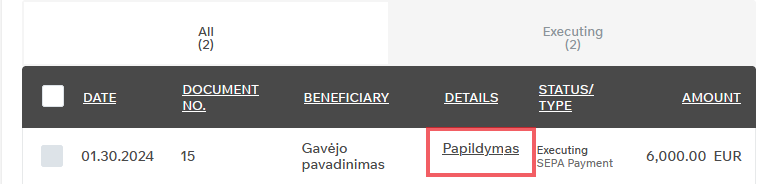

You can cancel pending payments by logging in to the Internet Banking and selecting the menu item Payments -> Payment overview and signing. Once you have found the payment you want to cancel, click on the text in the payment purpose field for that payment.

At the bottom of the payment review form that appears, click the Cancel button and confirm the cancellation by clicking the Yes button.

If the payment is successfully cancelled, the message Payment successfully cancelled will be displayed and the payment status will change to Cancelled.

- Share

If you notice that your account has not been debited or funds have not reached the recipient’s account, it is possible that your transfer has been rejected for some reason.

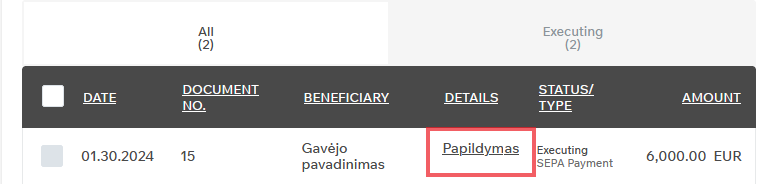

You can always check whether a transfer has been rejected and the reason for this by logging in to your Internet Bank, selecting Payments -> Payment overview and signing from the menu, finding the relevant payment and clicking on the text in the payment purpose field for that payment.

The reason for rejecting the payment will be provided at the bottom of the payment review form.

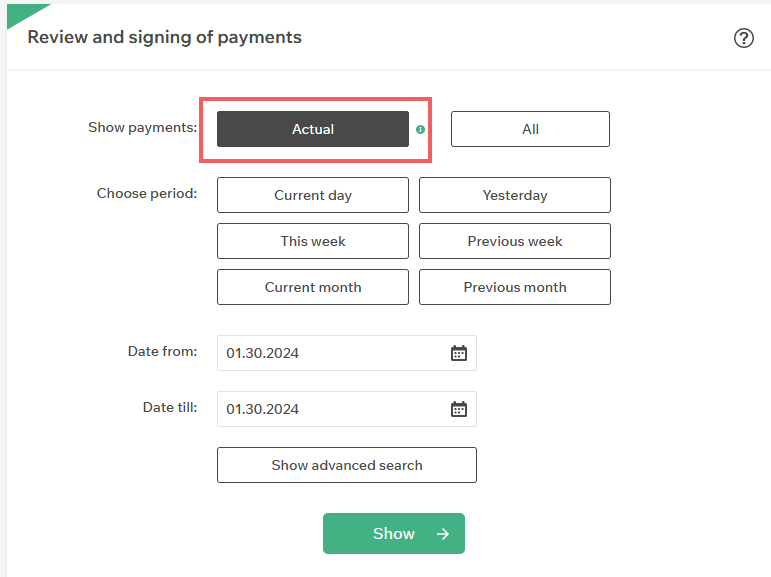

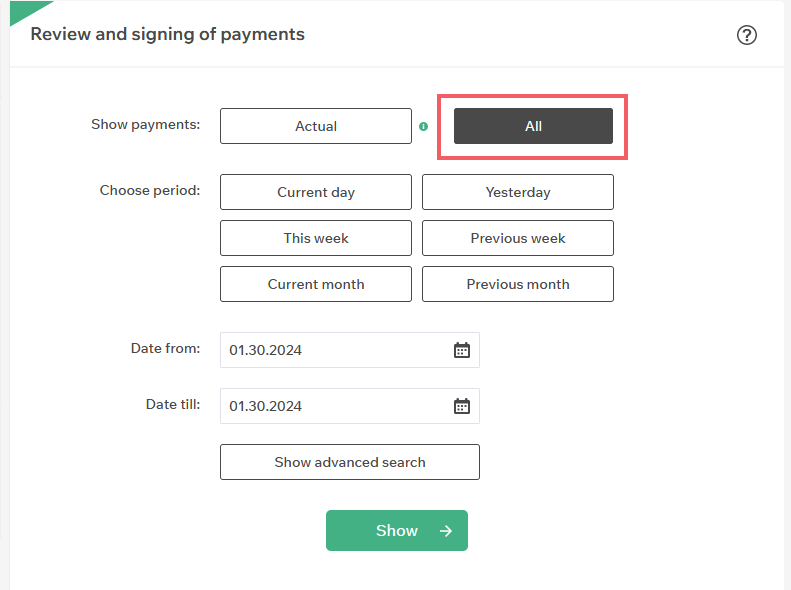

When searching for a transfer in the Payment overview and signing form, please note the available filters. If you choose to show only Current payments, the system will only show you today’s transfers. Select All to see transfers from the previous period.

- Share

Yes, in the internet bank, the representative of the business customer can log in to e-services.

In the event that a person other than the manager of the company connects to the e-services using the internet bank, the e-service provider (VMI, SODRA, NMA, etc.) must have a power of attorney confirming the right of the person (e.g. an accountant) to represent the business customer.

- Share

Yes, all business customers can import transfers into the internet bank. It is a convenient way to make scheduled transfers to different beneficiaries at the same time. One transfer import file can contain several types of transfers:

- SEPA transfers in euro to banks registered in Lithuania and the EEA (including payroll transfers to company employees);

- International transfers;

- Transfers in any currency within the bank.

To import transfers, export the ISO 20022 file in XML format from your accounting system and complete the following steps in the internet bank:

- In the menu item Payments, under Transfers, select Import transfers (XML), upload the ISO 20022 XML file to be imported and click on the Import button.

- After the system has imported the XML file, review the transfers in the payment list. If you notice any discrepancies or errors, please modify or delete the transfers in the internet bank.

- Tick the transfers you want to execute and sign them all at once with the login tool you use.

If the online account agreement requires an additional level of signature for the account from which the transfers are being made, payments will be made in the usual way, subject to the signatures of all required levels.

To find out how to export an ISO 20022 XML file from your accounting system, please contact the company that maintains it.

- Share

The mobile banking app is a smartphone app for private and business customers of Urbo Bankas, which allows you to directly manage your finances with Urbo Bankas at any time using your smartphone.

The mobile banking app is available in Lithuanian, English and Russian.

Download the mobile banking app to your smartphone!

- Share

You can subscribe to the Notification Centre service in the Internet Bank of Urbo Bankas. To subscribe to the service, under the menu item Accounts, go to Account notifications and select Notification Centre:

- Select the way you want to receive notifications

- Depending on the method you choose for receiving notifications, please provide a telephone number or e-mail address

- Select the account for which you want to receive information

- Choose one of the available conditions, after which a notification will be sent to you

- Enter the amount above or below which notifications will be sent

- Tick whether you would like to receive more detailed account information (account number, account currency, current account balance, amount of the last transaction and currency of the transaction) together with the notification

- Save your preferences

The Notification Centre service is free if you receive notifications of account balance changes by email. If you wish to be notified by SMS, you will be charged the bank’s fees for sending GSM SMS.

- Share

Yes, different notification conditions can apply to the same account. To receive notifications under different conditions, subscribe to a separate notification for each desired condition in the Internet Bank.

- Share

You can switch from your current SIM card to a special SIM card at your mobile operator’s store.

- Share

Smart-ID uses two different identification numbers:

- PIN1 is used to log in to electronic services and to access accounts such as your bank account

- PIN2 is for digital signatures, e.g., for banking transactions or signing a document

The use of two PINs ensures the security of your Smart-ID. You can only use Smart-ID if you have your own smart device and know your two PINs.

- Share

Yes, you can use a Smart-ID Basic account created for you at other banks to log in to Urbo Bank’s Internet Bank or mobile banking app. If you are logging in for the first time with a Smart-ID Basic account set up at another bank, you will need to authenticate your identity by other means.

You can do so in the following ways:

- Log in to your Internet Bank with your Mobile-ID or SMS code and tick the consent box in your Smart-ID settings to allow you to use Smart-ID Basic account in the future for logging in or signing documents.

- Visit your nearest bank branch and ask a customer service employee to confirm the validity of your existing account (be sure to bring the smartphone with the Smart-ID app with your active account).

- Share

If you have not performed any actions in your Internet Bank or mobile banking app that require a PIN1 or PIN2 for confirmation, but you have received a notification on your device asking you to enter your PIN1 or PIN2, do not enter the requested PINs under any circumstances. Cancel the request and immediately inform the bank of the attempted access to your Internet Bank or mobile banking app using the contact details provided.

If you are using an iOS device, we recommend that you click on the appropriate button in the Smart-ID app, which will notify the service provider SK-Solution of the unauthorised request.

- Share

Yes, business clients can grant authorization to their chosen representatives to manage the company's accounts online by visiting a bank branch or sending a signed message via online banking.

The manager of the company may assign different rights to his or her company representatives according to the individual functions performed by the company’s employees. The manager of the company can decide how many and what rights are granted to individuals. The following rights may be granted:

- To receive an account statement;

- To see the account balance;

- To fill in documentation forms;

- Right of first signature;

- Right of second signature (used when signing payments from an account that requires more than one signature).

For example, if you want your company’s accountant to enter payments into the internet bank, but the system will only execute them upon your revision and approval, grant the selected employee the following rights:

- To fill in documentation forms;

- Right of second signature.

In this case, all your payments will only be made after they have been signed at both levels, i.e. after your final approval.

Branch employees will be happy to tell you more and help you choose the best way to manage your internet bank accounts for your business. Please visit the nearest bank branch.

- Share

To assign an authorized person for account management online, the company manager must log in to the "Urbo" Internet Bank and send a signed message to the bank requesting the assignment of the authorized person to the account.

The request must include: the person's first name, last name, date of birth, personal email, and phone number, as well as the accounts to be assigned.

Additionally, the request must specify the assigned account management rights:

- MI – can receive the account statement;

- SL – can check the account balance;

- VP – can fill out document forms and import payment orders;

- P1 – has the first electronic signature right (creates, signs, and approves the payment);

- P2 – has the second electronic signature right (used when signing payments from an account that requires more than one signature).

The authorized person will receive an identification link via email, which will be sent by a bank's employee. After the authorized person completes the identification process and both the company manager and the authorized person sign an additional agreement, access to account management will be activated.

Important: The authorized person can only be assigned remotely if they have an electronic signature (Mobile-ID or a qualified Smart-ID account).

- Share

An account statement is a document that provides detailed information about all financial transactions conducted within an account (including commission fees and others).

A confirmation of online payment (payment order) is a document that provides information about a payment. If the document includes execution date of the transfer, ten the transfer can be considered executed.

- Share

You can find the confirmation of online payment document under Payments -> Payment overview and signing.

Locate the desired payment, click on its details, and then click on the printer icon. The document will be sent to your computer and prepared for printing.

Plase note that in the Urbo Internet Bank, you can only find confirmations for payments made through internet banking or the mobile application. If you made the transfer at a bank branch, the bank employee assisting you will ask you to sign, verify with their signature, and provide you with the payment order.

- Share

Payments

SEPA is the transfer of money from the customer’s account to another account at the instruction of the account provider. Transfers are made in Euro to accounts opened in SEPA countries. The SEPA (Single European Payment Area) countries are members of the EEA (the EU countries plus Iceland, Liechtenstein and Norway) and the United Kingdom, Switzerland, Andorra, Gibraltar, Monaco, San Marino, and the Vatican.

Non-SEPA is the transfer of money from the customer’s account to another account at the instruction of the account provider. Transfers are made in currencies other than the Euro or to the accounts opened in countries outside the SEPA.

- Share

- Intra-bank transfers, i.e., transfers of money between Urbo bank accounts (your own or those of other persons).

- SEPA payments, i.e., SEPA-compliant payments to the EEA (European Economic Area) countries (European Union, Norway, Iceland, Liechtenstein) and the United Kingdom, Switzerland, Andorra, Gibraltar, Monaco, San Marino, and the Vatican.

- SEPA instant payments (SEPA transfers up to EUR 100,000 are only made to banks/payment service intermediaries that are members of the SEPA Instant Payment Service (SEPA-INST) scheme).

- Recurring payments, i.e., regular ordinary SEPA payments made by the bank to the payee’s account at the customer’s instruction, in accordance with a chosen payment schedule.

- Payments for services, i.e., payments to service providers using a universal payment form (template).

The terms and conditions for the execution of payment orders are set out in the Payment Service Rules of the Bank and Transactions, and the information provided in the Payment Order Form.

- Share

Identification of the payer/recipient requires the name of the payer/recipient and the bank account number (international IBAN format)*.

* The bank credits the funds to the payment account according to the account number (IBAN) provided in the customer’s payment order and does not check whether the provided account number corresponds to the name of the holder of the account, so please make sure the recipient’s account number is correct every time!

- Share

Possible frequency of transfers:

- Specifying the day of the month (daily, certain selected days of the month);

- Specifying the weeks of the month (weekly, every day of the week, certain days of the week);

- Specifying the months of the year (monthly, every other month, quarterly, specific months).

The following debiting can be selected as a recurring payment:

- Fixed amount;

- Full balance on the account;

- Any amount in excess of the specified minimum balance that must remain in the account after the transfer has been completed;

- Part of the amount, expressed as a percentage, to be debited from the balance on the account.

A recurring payment transaction can only be terminated on the day you request cancellation of the recurring payments.

There is no possibility to make an advance request for cancellation of recurring payments at a future date of your choice.

- Share

The terms and conditions for the execution of international payment orders are set out in the Payment Service Rules of the Bank, the Price List of Services and Transactions, and the information provided in the Payment Order Form.

- Share

Anti-money laundering, counter-terrorist financing, anti-fraud and international sanctions and restrictive measures in place at Urbo Bankas include enhanced monitoring of payment transactions. Enhanced monitoring of payment transactions is carried out by suspending outgoing or incoming payments and checking the documents supporting the payment transactions. Please note that in all cases, payments sent to or received from high-risk regions are suspended. The following are considered high-risk regions:

- Countries subject to enhanced monitoring by the Financial Action Task Force (FATF) (Turkey, United Arab Emirates, etc., see list of countries);

- Countries on the European Commission’s list of high-risk countries (paragraph 1, Annex 1 to Regulation (EU) 2016/1675 – Afghanistan, Philippines, Morocco, Pakistan, etc., see list of countries);

- Countries included in the list of target territories approved by the Ministry of Finance of the Republic of Lithuania (Order No. 344 of 29/12/2001, see list of countries);

- Russia and Belarus – due to the international sanctions imposed on these countries, we recommend that you do not make payments to Russia and Belarus; for more detailed information on the sanctions and payment restrictions imposed on these countries, see the FAQs on payments with Belarus, Russia;

- Other countries of the Commonwealth of Independent States (Azerbaijan, Armenia, Kazakhstan, Kyrgyzstan, Moldova, Tajikistan, Turkmenistan, Uzbekistan), due to the high risk of circumventing international sanctions against Russia and Belarus.

The documents normally requested to support the transaction include contracts, VAT invoices and, in the case of supplies or transport, bills of lading, customs declarations and certificates of origin. You may also be asked to provide additional documentation, such as registration documents revealing the identity of the private persons (beneficial owners) controlling the business partner, in order to verify that the customer’s business partner is not subject to international sanctions or restrictive measures.In cases where the risk of a payment transaction is determined to be unacceptable to Urbo Bankas, or where the customer does not provide all the documents necessary for the risk assessment of the payment transaction, Urbo Bankas may refuse to execute or credit the payment.

- Share

It is recommended that settlements with Russia and Belarus should be excluded. Customers who intend to carry out payment transactions with Russia or Belarus are kindly requested to coordinate such settlements with Urbo Bankas in advance. Payment transactions with Russia or Belarus that have not been agreed in advance, as well as payment transactions that pose an unacceptable risk of international sanctions to Urbo Bankas, are not executed.

Please note that in order to properly implement the international sanctions imposed on Russia and Belarus, all payment transactions executed (sent and received) by the Urbo Bankas with Russia, Belarus or other countries of the Commonwealth of Independent States are suspended for verification. When payment transactions are suspended, the supporting documents are requested (e.g. contracts, invoices, bills of lading and customs declarations, or acts of provision of services) and the details of the supporting documents (e.g. the date and number of the contract, the date and number of the invoice, the Combined Nomenclature codes of the goods, or the names of the services) are indicated in the purpose of payment.

When making settlements with other countries of the Commonwealth of Independent States, we urge you to make sure that transactions are not aimed at circumventing international sanctions against Russia and Belarus (to identify the origin of the goods or the final purchasers of the goods, to identify the real beneficiaries of the partners, and to verify the identity of the other parties involved in the transaction).

Below you can find detailed information about the international sanctions implemented by Urbo Bankas:

- European Union: https://sanctionsmap.eu

- United Nations: https://www.un.org

- United States of America: https://sanctionssearch.ofac.treas.gov/

- Great Britain: https://www.gov.uk/government/organisations/office-of-financial-sanctions-implementation

- Share

The bank accepts bearer cheques in euros (EUR) and British Pounds Sterling (GBP). The Bank accepts cheques issued by the EU (except Greece, Austria), British, Norwegian and Canadian banks.

- Share

The cheque must be presented for cashing less than 5 months after the date of issue. When the cheque is cashed, the amount indicated on the cheque, after deduction of bank fees for cashing the cheque, will be transferred to the Urbo Bankas account specified by you.

- Share

It is an electronic version of a VAT invoice sent to the recipient (payer), i.e., directly to the Urbo Bank customer’s online bank account.

- Share

With an Automatic E-Invoice Payment Agreement, you can make insurance or lease payments, pay for utilities, Internet and phone connection, and other services (gym memberships, subscriptions to publications, etc.).

- Share

When entering into an Automatic E-Invoice Payment Agreement, you can choose:

-

The invoice payment date;

-

Maximum limits for invoice payments.

- Share

You can subscribe to e-invoices from the following service providers. E-invoices from service providers that are not on the list can only be subscribed to directly with the service provider.

Service providers:

2 EUROPE, UAB

4FINANCE, UAB

ACTIVE VILNIUS/ FABIJONIŠKIŲ BASEINAS, VŠĮ

ACTIVE VILNIUS/ LAZDYNŲ BASEINAS, VŠĮ

ALYTAUS MIESTO SAVIVALDYBĖS ADMINISTRACIJA

ALYTAUS REGIONO ATLIEKŲ TVARKYMO CENTRAS, UAB

ALYTAUS ŠILUMOS TINKLAI, UAB

ASHBURN INTERNATIONAL, UAB

ASMENYBĖS UGDYMO KULTŪROS CENTRAS, VŠĮ*NARIO MOKESTIS

ASOCIACIJA RAUDONOS NOSYS GYDYTOJAI KLOUNAI

AS GO3 BALTICS (GO3)

ATLETO SPORTO PROJEKTAI, VŠĮ

AUKŠTAITIJOS VANDENYS

AUROJA/ SPORTO KLUBO EOLA ABONEMENTAS, UAB

AVIVA LIETUVA, UAGDPB

BALTERMA SYSTEMS, UAB

BALTIC EMPLOYMENT SOLUTIONS, UAB

BALTICUM TV, UAB

BERENDSEN TEXTILE SERVICE, UAB

BITĖ LIETUVA, UAB

BLENDER LITHUANIA F1, UAB

BLENDER LITHUANIA, UAB

BRINKS LITHUANIA, UAB

BTA BALTIC INSURANCE COMPANY FILIALAS LIETUVOJE

BUTŲ ŪKIO VALDOS, USB BUV MOKĖJIMO PRANEŠIMAS

CASTRADE SERVICE, UAB

CGATES, UAB

CIRCLE K LIETUVA, UAB

CITY BOXING SPORTO KLUBO NARYSTĖ

COMPENSA LIFE VIENNA INSURANCE SE

COMPENSA VIENNA INSURANCE GROUP ADB

CSC TELECOM, UAB

DEBRECENO VALDA, UAB

DINETAS, UAB

DZŪKIJOS VANDENYS, UAB

ECOFON, UAB

ECOSERVICE PROJEKTAI, UAB

ECOSERVICE, UAB

EGA LT UAB

EKSKOMISARŲ BIURAS, UAB

ELEKTA, UAB

ELEKTRONINIŲ MOKĖJIMŲ AGENTŪRA, UAB

ELEKTRUM LIETUVA, UAB

ELIS TEXTILE SERVICE, UAB

ENEFIT, UAB

ENERGIJOS SKIRSTYMO OPERATORIUS, AB

EOLA PLIUS, VŠĮ

EOLA, UAB

ETANETAS, UAB

EUROCASH1, UAB

EUROCOM, UAB

EVATECHAS MB

FABETA, UAB

FANKAS, UAB

G4S CASH SOLUTIONS, UAB

G4S LIETUVA, UAB

GARANT, UAB

GELSVA, UAB

GF BANKAS, UAB

GYM PLIUS, UAB

GYVYBĖS DRAUDIMO UAB SB DRAUDIMAS

GJENSIDIGE, ADB

GOINDEX PASAULIO AKCIJŲ FONDAS

GOINDEX SUBALANSUOTAS FONDAS

GREN LIETUVA, UAB

GRIFS AG, UAB

GSM APSAUGA, UAB

HERKAUS KLUBAS, UAB

IF P&C INSURANCE AS FILIALAS

IGNITIS

IMPULS LTU, UAB

INBANK FILIALAS, AS

INIT, UAB

INSERVIS, UAB

INVL X SB DRAUDIMAS DRAUDIMO ĮMOKA

INVL X ŠIAULIŲ BANKO III PAKOPOS FONDAS

JURITA, UAB

KAUNO ARENA (UŽ BASEINO NARYSTĘ), UAB

KAUNO ŠVARA

KAUNO VANDENYS, UAB

KAVAMEDIA, UAB

KILO GRUPĖ, UAB

KLAIPĖDOS BASEINAS, UAB

KLAIPĖDOS ENERGIJA, AB

KLAIPĖDOS VANDUO, AB

KOPA GYM UŽ SUTEIKTAS PASLAUGAS

KRETINGOS BŪSTAS

KRETINGOS VANDENYS, UAB

KUPIŠKIO BASEINAS_ EINAMOJO MĖNESIO SĄSKAITA UŽ SPORTO IR SVEIKATINGUMO CENTRO NARYSTĘ

L-2002 891-OJI INDIVIDUALIŲ GYVENAMŲJŲ NAMŲ STATYBOS BENDRIJA

LANSNETA, UAB

LEMON GYM (UAB GYM LT)

LIETUVOS DRAUDIMAS, AB

LIETUVOS NACIONALINIS UNICEF KOMITETAS ASOCIACIJA

LIETUVOS PROFESINĖ SĄJUNGA SANDRAUGA

LINDE GAS UAB

LITESKO FIL.MARIJAMPOLĖS ŠILUMA, UAB

LITESKO FILIALAS ALYTAUS ENERGIJA, UAB

LITESKO FILIALAS BIRŽŲ ŠILUMA, UAB

LITESKO FILIALAS DRUSKININKŲ ŠILUMA, UAB

LITESKO FILIALAS KELMĖS ŠILUMA, UAB

LITESKO FILIALAS PALANGOS ŠILUMA, UAB

LITESKO FILIALAS TELŠIŲ ŠILUMA, UAB

LITESKO FILIALAS VILKAVIŠKIO ŠILUMA, UAB

LK SERVICE, UAB

LPF SOS VAIKŲ KAIMAI

LUKOIL BALTIJA, UAB

LUMINOR LIZINGAS, UAB

M7 PLIUS, UAB

MALTOS ORDINO PAGALBOS TARNYBA

MANDATUM LIFE INSURANCE COMPANY LIMITED LIETUVOS FILIALAS

MEMBAS, UAB

METLIFE T.U.Z.R.S.A

MOKESTIS UŽ OXYGYM MĖNESINĘ NARYSTĘ

MOKILIZINGAS, AB

MŪSŲ SPORTAS, UAB

NERINGOS VANDUO, UAB

NESTE LIETUVA, UAB

NOVITI, UAB

ODONTOLOGIJOS KLINIKA AMICUS DENTIS, UAB

OMNIVA LT UAB

PALANGOS BASEINO SPORTO KLUBO NARIO MOKESTIS(UAB HIDRANA)

PANEVĖŽIO BUTŲ ŪKIS, AB

PANEVĖŽIO ENERGIJA, AB

PARAMOS FONDAS GERŲ DARBŲ DIRBTUVĖ

PERLAS ENERGIJA (ELEKTRA)

PLAUKIMO KLUBAS, VŠĮ

PRAKTIŠKAS, UAB

PRIEMIESTIS, UAB

PROGMERA, UAB

PUŠŲ TERASOS, DGNSB

PZU LIETUVA GYVYBĖS DRAUDIMAS, UAB

RADIJO ELEKTRONINĖS SISTEMOS, UAB

ROBOLABS, UAB

ROKIŠKIO KOMUNALININKAS, AB

ROKIŠKIO VANDENYS, UAB

SANTAROS KLINIKŲ GYDYTOJŲ SĄJUNGA

SAUGOS TARNYBA ARGUS, UAB

SAVICKO SPORTO KLUBAS, UAB

SB LIZINGAS UAB

SEB GYVYBĖS DRAUDIMAS, AB

SEB LIFE AND PENSION BALTIC SE LIETUVOS FILIALAS

SEESAM INSURANCE AS LIETUVOS FILIALAS

SĮ KRETINGOS KOMUNALININKAS

SĮ VILNIAUS ATLIEKŲ SISTEMOS ADMINISTRATORIUS

SIA CITADELE LEASING LIETUVOS FILIALAS

SIA UNICREDIT LEASING LIETUVOS FILIALAS

SIGRETA, UAB

SOS VAIKŲ KAIMŲ LIETUVOJE DRAUGIJA

SPLIUS, UAB

SPORTO INFRASTRUKTŪRA, UAB

SPORTO KLUBAS BUDORA

SPORTO KLUBAS - PRIKLAUSOMI NUO SPORTO

SPORTO KLUBŲ SISTEMA, UAB

SPORTO REALISTAI, UAB

STOVA, UAB

SVEIKIEJI BALTAI, UAB

SWEDBANK P&C INSURANCE AS LIETUVOS FILIALAS

SWIFT ARENA UŽ SUTEIKTAS PASLAUGAS

SWIMCADEMY PLAUKIMO AKADEMIJA

ŠIAULIŲ VANDENYS, UAB

TAVO SPORTO AKADEMIJA, UAB

TELE2, UAB

TELEDEMA, UAB

TELIA NAMŲ/IT IR BIURO PASLAUGOS

THE MUSCLE MAKERS, UAB

TRAKŲ RAJ. KĮK, UAB

TRAKŲ ŠILUMOS TINKLAI, UAB

TRENIRUOČIŲ PASAULIS, UAB

TV PLAY BALTICS (HOME3), AS

VAIKO RAIDOS KLINIKA

VERKIŲ BŪSTAS, UAB

VERSLO TILTAS, UAB

VILKAVIŠKIO ŠILUMOS TINKLAI, UAB

VILNIAUS ŠILUMOS TINKLAI, AB

VILNIAUS VANDENYS, UAB

VITĖS VALDOS, UAB

VO GELBĖKIT VAIKUS

VSA VILNIUS, UAB

ŽALGIRIO PLAUKIMO AKADEMIJA

- Share

An electronic card reader is a data input device that reads data from the magnetic stripe or chip of a payment card and transmits the settlement transaction data to the bank that handles card transactions

- Share

The card readers of our partners EPS LT and Nets Denmark A/S Lithuanian branch meet all the requirements of the international organisations Visa and MasterCard.

Depending on your needs, you can choose from the following options:

Card readers not connected to the cash register

- A stationary card reader if you intend to use it in one location

- A mobile card reader, if you plan to use the reader in different locations

| Type | Where is it commonly used? | Who commonly uses it? |

|---|---|---|

| Stationary | In the marketplaces with a small number of buyers or customers | Food products, clothing, shoe stores, bakeries, hairdressers, exhibition organizers, etc. |

| Mobile | Food products, clothing, shoe stores, bakeries, hairdressers, exhibition organizers, etc. | Cafes, restaurants, car rental companies, taxis, etc. |

Card readers connected to the cash register

| Type | Where is it commonly used? | Who commonly uses it? |

|---|---|---|

| Stationary | In the marketplaces with a large number of buyers or customers (where it is important to serve the customer quickly) | Large supermarkets, petrol stations, pharmacies, chain stores for shoes, clothes etc. |

| Mobile | In the marketplaces with a large number of buyers or customers (where it is important to serve the customer quickly) | Large supermarkets, petrol stations, pharmacies, chain stores for shoes, clothes etc. |

- Share

Service charges apply when accepting card payments:

- Card service charge. Card service charge consists of a percentage of the settlement amount (based on the turnover of card payments) and a fixed amount.

- Monthly rent and maintenance fee. Card readers can be rented from EPS LT, Nets Denmark A/S Lithuanian branch, partner of Urbo Bankas, or from another card reader provider.

For more information about this service, its terms and conditions and fees, please fill in the enquiry form and a responsible officer of the bank will contact you with detailed information on the terms and conditions for installing a card reader.

- Share

Currency exchange

Service plans

A resident legal entity may order a business service plan, except for legal entities where at least one of them is:

- In the ownership/control structure of the participants/shareholders and (or) at least one of the beneficiaries is a non-Lithuanian citizen;

- Or at least one of the participants/shareholders in the ownership/control structure is a legal entity registered outside the Republic of Lithuania.

- Share

- The customer must notify the Bank in writing 30 calendar days in advance of the termination of the service plan.

- If you terminate your service plan before the end of a calendar month, the monthly plan fee will apply for the calendar month regardless of the date of termination. The amount is written-off on the last calendar day of the month.

- The Bank has the right to terminate the application of the service plan by sending a notice to the customer if the customer does not comply with the Rules for Provision of Payment Services and the Terms and Conditions of Use of the Business Service Plan and the bank ceases to apply the Service Plan or the service included in it.

- Share

You can change your service plan by logging in to your internet bank. Once the digital application form is filled, your plan will be changed from the first day of the following month.

- Share

- The fee is paid on the last calendar day of each month, irrespective of whether the customer has used the services included in the service plan;

- Unused services are not transferred to the next calendar month.

- Share

Business Accounts

A savings account is an account for the purpose of forming the authorised capital of the Customer, the legal entity to be established (for the purpose of accumulating initial cash contributions).

- Share

Deposit (trust) account is opened only for the statutory customers for the safekeeping and management of funds entrusted to them by other persons, where these funds remain the property of the persons who entrusted them.

- Share

A savings account with Urbo Bank may be opened by the founder of the company or a person authorised by the founder.

A deposit account is opened for persons who, in accordance with the legislation of the Republic of Lithuania, may hold funds of third parties as deposits or in trust.

The account can be opened for:

- Lawyers and notaries;

- Bailiffs, courts and prosecutor offices;

- STI, Customs departments;

- Financial brokerage firms, banks and other credit institutions.

- Share

To open a deposit account, legal persons must have an Urbo Bank account in their name.

A savings account can be opened:

- At a bank branch on presentation of the documents required by the bank;

- Electronically via the State Enterprise Centre of Registers.

Once the company is registered, you can convert your savings account into a bank account by visiting your nearest bank branch (insert link to list of departments here)

- Share