Savings

Daily banking

Other services

"Urbo" is a new bank name

E-banking

To download your account statement, select Accounts and Account statement from the menu. Select the account and the period for which you would like to receive an account statement and click the Export button.

Once you have done this, select the format (XML, XLS, CSV or PDF) in which you would like to download your account statement and click the Save button.

- Share

You can find transaction limits that apply to your accounts in the Online Account Management Agreement or the Internet Bank (go to Settings -> Transaction limits). You can also find out the applicable limits by visiting your nearest bank branch.

You can change the transaction limits in the Internet Bank or via the mobile banking app. It is important to remember that due to the potential risk of fraud and the security of your funds, you can set the following maximum limits for payment transactions in the Internet Bank or mobile banking app:

- Single payment transaction limit – EUR 200,000;

- Daily payment transaction limit – EUR 200,000;

- Monthly payment transaction limit – EUR 2,000,000.

The limits changed in the Internet Bank or mobile banking app will not take effect until the following day. If you need transaction limits above the maximum or want them to take effect immediately, please visit your nearest branch.

- Share

To log in to internet bank, please use your User ID (which can be found in the Online Account Agreement) and your usual means of identification: your Smart-ID, Mobile-ID or SMS code.

- Share

If you are logging in with Smart-ID:

- Check that you have entered the correct User ID. You can find your User ID in your Agreement of Account Management by Internet

- Make sure you enter the correct national ID number in the national ID number field. If you don’t have a national ID number, you can see the identification number you need to enter in the national ID number field in the Smart-ID app

If you are logging in with Mobile-ID:

- Check that you have entered the correct User ID. You can find your User ID in your Online Account Management Agreement

- Make sure you are using the correct telephone number and that the mobile signature service is provided to the telephone number you have provided

- If you don’t remember your sPIN1 and sPIN2 codes, or if you have blocked them, you can find information on your mobile operator’s (Telia, Tele2, Bitė, Teledema) website

If you are logging in with an SMS code:

- Check that you have entered the correct User ID. You can find your User ID in your Online Account Management Agreement

- Make sure you have entered the correct password

- If you enter incorrect details 4 times in a row, the system will automatically block you for a period of 30 minutes; if you enter incorrect details 8 times, your access to the Internet Bank will be permanently blocked

- If you can’t remember your password, you can always try another means of logging in, such as Smart-ID or Mobile-ID

- Share

If your access is temporarily blocked:

If you see the message: “Your access is temporarily blocked. Try again after XXX minutes”, it will be unblocked automatically after 30 minutes. Wait for the specified amount of time and try to log in again.

While you’re waiting:

- Make sure that you have the correct User ID. You can find your User ID in your Online Account Management Agreement.

- If you are logging in with an SMS code, please try to remember your password. If you can’t remember your password, try another means of logging in, such as Smart-ID or Mobile-ID.

- Please note that the maximum number of additional attempts (30 minutes apart) is 4. If you exceed the number of additional attempts allowed, your access will be automatically blocked.

If your access has been blocked:

If you see the message: “Your access is blocked.”, please call 19 300 or +370 52644800 (if you are abroad) for unblocking.

Our call centre is open on weekdays from 8 a.m. to 5 p.m.

You can also visit your nearest Urbo Bankas branch. Make sure you have your ID card or passport with you.

- Share

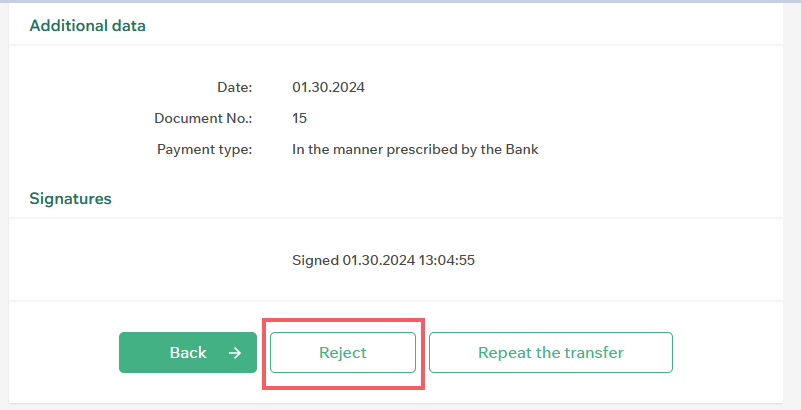

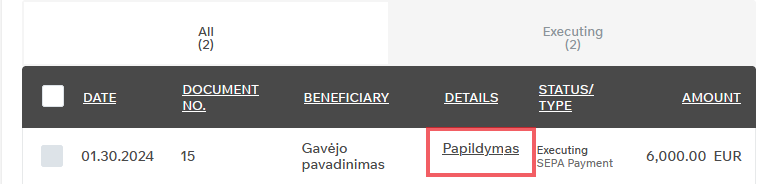

You can cancel pending payments by logging in to the Internet Banking and selecting the menu item Payments -> Payment overview and signing. Once you have found the payment you want to cancel, click on the text in the payment purpose field for that payment.

At the bottom of the payment review form that appears, click the Cancel button and confirm the cancellation by clicking the Yes button.

If the payment is successfully cancelled, the message Payment successfully cancelled will be displayed and the payment status will change to Cancelled.

- Share

If you notice that your account has not been debited or funds have not reached the recipient’s account, it is possible that your transfer has been rejected for some reason.

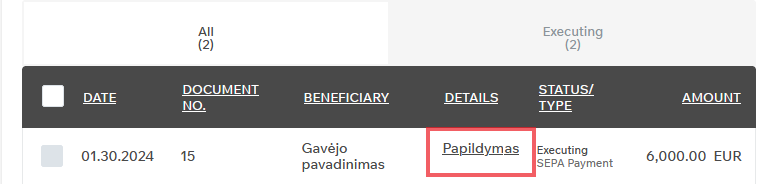

You can always check whether a transfer has been rejected and the reason for this by logging in to your Internet Bank, selecting Payments -> Payment overview and signing from the menu, finding the relevant payment and clicking on the text in the payment purpose field for that payment.

The reason for rejecting the payment will be provided at the bottom of the payment review form.

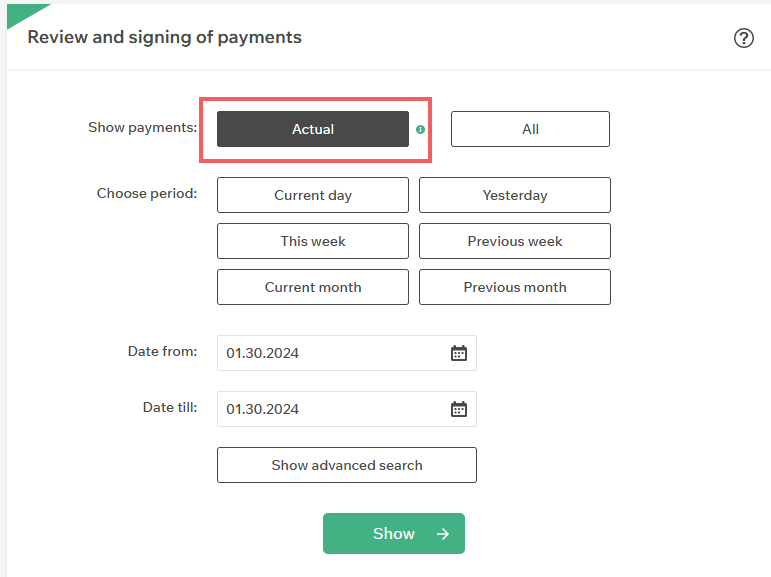

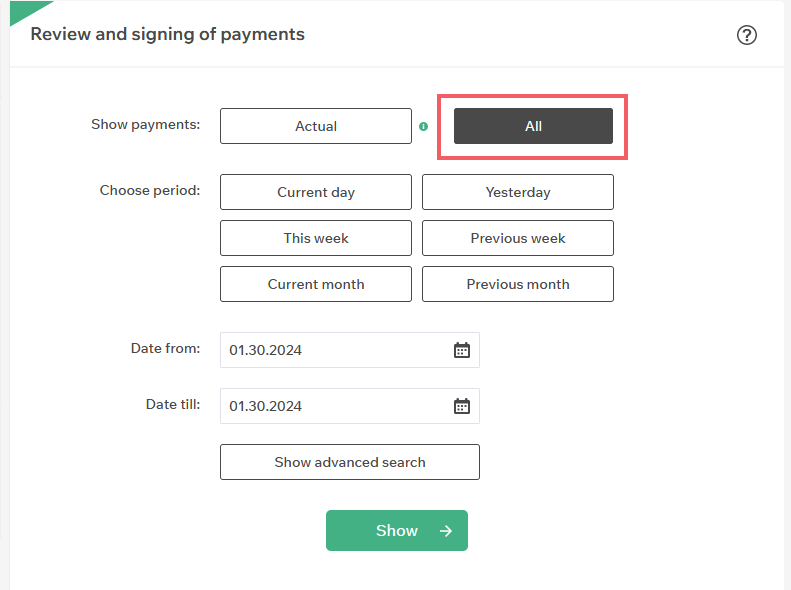

When searching for a transfer in the Payment overview and signing form, please note the available filters. If you choose to show only Current payments, the system will only show you today’s transfers. Select All to see transfers from the previous period.

- Share

Yes, in the internet bank, the representative of the business customer can log in to e-services.

In the event that a person other than the manager of the company connects to the e-services using the internet bank, the e-service provider (VMI, SODRA, NMA, etc.) must have a power of attorney confirming the right of the person (e.g. an accountant) to represent the business customer.

- Share

Yes, all business customers can import transfers into the internet bank. It is a convenient way to make scheduled transfers to different beneficiaries at the same time. One transfer import file can contain several types of transfers:

- SEPA transfers in euro to banks registered in Lithuania and the EEA (including payroll transfers to company employees);

- International transfers;

- Transfers in any currency within the bank.

To import transfers, export the ISO 20022 file in XML format from your accounting system and complete the following steps in the internet bank:

- In the menu item Payments, under Transfers, select Import transfers (XML), upload the ISO 20022 XML file to be imported and click on the Import button.

- After the system has imported the XML file, review the transfers in the payment list. If you notice any discrepancies or errors, please modify or delete the transfers in the internet bank.

- Tick the transfers you want to execute and sign them all at once with the login tool you use.

If the online account agreement requires an additional level of signature for the account from which the transfers are being made, payments will be made in the usual way, subject to the signatures of all required levels.

To find out how to export an ISO 20022 XML file from your accounting system, please contact the company that maintains it.

- Share

The mobile banking app is a smartphone app for private and business customers of Urbo Bankas, which allows you to directly manage your finances with Urbo Bankas at any time using your smartphone.

The mobile banking app is available in Lithuanian, English and Russian.

Download the mobile banking app to your smartphone!

- Share

You can subscribe to the Notification Centre service in the Internet Bank of Urbo Bankas. To subscribe to the service, under the menu item Accounts, go to Account notifications and select Notification Centre:

- Select the way you want to receive notifications

- Depending on the method you choose for receiving notifications, please provide a telephone number or e-mail address

- Select the account for which you want to receive information

- Choose one of the available conditions, after which a notification will be sent to you

- Enter the amount above or below which notifications will be sent

- Tick whether you would like to receive more detailed account information (account number, account currency, current account balance, amount of the last transaction and currency of the transaction) together with the notification

- Save your preferences

The Notification Centre service is free if you receive notifications of account balance changes by email. If you wish to be notified by SMS, you will be charged the bank’s fees for sending GSM SMS.

- Share

Yes, different notification conditions can apply to the same account. To receive notifications under different conditions, subscribe to a separate notification for each desired condition in the Internet Bank.

- Share

You can switch from your current SIM card to a special SIM card at your mobile operator’s store.

- Share

Smart-ID uses two different identification numbers:

- PIN1 is used to log in to electronic services and to access accounts such as your bank account

- PIN2 is for digital signatures, e.g., for banking transactions or signing a document

The use of two PINs ensures the security of your Smart-ID. You can only use Smart-ID if you have your own smart device and know your two PINs.

- Share

Yes, you can use a Smart-ID Basic account created for you at other banks to log in to Urbo Bank’s Internet Bank or mobile banking app. If you are logging in for the first time with a Smart-ID Basic account set up at another bank, you will need to authenticate your identity by other means.

You can do so in the following ways:

- Log in to your Internet Bank with your Mobile-ID or SMS code and tick the consent box in your Smart-ID settings to allow you to use Smart-ID Basic account in the future for logging in or signing documents.

- Visit your nearest bank branch and ask a customer service employee to confirm the validity of your existing account (be sure to bring the smartphone with the Smart-ID app with your active account).

- Share

If you have not performed any actions in your Internet Bank or mobile banking app that require a PIN1 or PIN2 for confirmation, but you have received a notification on your device asking you to enter your PIN1 or PIN2, do not enter the requested PINs under any circumstances. Cancel the request and immediately inform the bank of the attempted access to your Internet Bank or mobile banking app using the contact details provided.

If you are using an iOS device, we recommend that you click on the appropriate button in the Smart-ID app, which will notify the service provider SK-Solution of the unauthorised request.

- Share

Yes, business clients can grant authorization to their chosen representatives to manage the company's accounts online by visiting a bank branch or sending a signed message via online banking.

The manager of the company may assign different rights to his or her company representatives according to the individual functions performed by the company’s employees. The manager of the company can decide how many and what rights are granted to individuals. The following rights may be granted:

- To receive an account statement;

- To see the account balance;

- To fill in documentation forms;

- Right of first signature;

- Right of second signature (used when signing payments from an account that requires more than one signature).

For example, if you want your company’s accountant to enter payments into the internet bank, but the system will only execute them upon your revision and approval, grant the selected employee the following rights:

- To fill in documentation forms;

- Right of second signature.

In this case, all your payments will only be made after they have been signed at both levels, i.e. after your final approval.

Branch employees will be happy to tell you more and help you choose the best way to manage your internet bank accounts for your business. Please visit the nearest bank branch.

- Share

To assign an authorized person for account management online, the company manager must log in to the "Urbo" Internet Bank and send a signed message to the bank requesting the assignment of the authorized person to the account.

The request must include: the person's first name, last name, date of birth, personal email, and phone number, as well as the accounts to be assigned.

Additionally, the request must specify the assigned account management rights:

- MI – can receive the account statement;

- SL – can check the account balance;

- VP – can fill out document forms and import payment orders;

- P1 – has the first electronic signature right (creates, signs, and approves the payment);

- P2 – has the second electronic signature right (used when signing payments from an account that requires more than one signature).

The authorized person will receive an identification link via email, which will be sent by a bank's employee. After the authorized person completes the identification process and both the company manager and the authorized person sign an additional agreement, access to account management will be activated.

Important: The authorized person can only be assigned remotely if they have an electronic signature (Mobile-ID or a qualified Smart-ID account).

- Share

An account statement is a document that provides detailed information about all financial transactions conducted within an account (including commission fees and others).

A confirmation of online payment (payment order) is a document that provides information about a payment. If the document includes execution date of the transfer, ten the transfer can be considered executed.

- Share

You can find the confirmation of online payment document under Payments -> Payment overview and signing.

Locate the desired payment, click on its details, and then click on the printer icon. The document will be sent to your computer and prepared for printing.

Plase note that in the Urbo Internet Bank, you can only find confirmations for payments made through internet banking or the mobile application. If you made the transfer at a bank branch, the bank employee assisting you will ask you to sign, verify with their signature, and provide you with the payment order.

- Share