Financing

Savings

Other services

"Urbo" is a new bank name

Become a customer

- A private person for his/her own personal needs;

- A private person (attorney-in-fact) acting under a power of attorney certified by a notary – for the benefit of another person (principal). This service is only available in bank branches.

- Share

You will need to identify yourself with a Smart-ID or Mobile-ID, as well as provide photos of your identity document and take a selfie. You will be asked to fill in a Know Your Customer Form and sign it with an electronic signature.

- We will inform you of the next steps within 1 working day of your application;

- If you have provided all the details when completing your application, you will receive a notification from the Bank at the e-mail address you provided when completing your application to sign the agreement documents;

- Once you have signed the agreement, you will receive a notification to start using our services.

You will be contacted on the contact details you have provided for further information in the event of a rejection of your application.

You can become a customer of our bank online by clicking on the following link - Become a customer

Links

- Share

- Transfer money in euro and foreign currency to other bank accounts;

- Make recurring payments;

- Use the e-invoice service;

- Pay utility bills and make payments for other services;

- Receive money in euro and foreign currency from other banks;

- Deposit and withdraw cash;

- Make a deposit;

- Buy, sell foreign currency;

- Cash bearer cheques;

- Get consumer and mortgage loans;

- Perform other financial transactions.

You can manage your bank accounts using online banking, the mobile app or by visiting your nearest bank branch.

Links

- Share

The bank account switch service offers an option to transfer your existing payment services and account balance from other banks to Urbo.

How do I switch accounts?

- Open an account with Urbo Bankas. You can do this at a branch or online.

- Fill in the account switch request form and familiarise yourself in advance with all the terms and conditions of switching your account (please note that the service will be completed not later than within 13 working days from the date of the request, but you can specify a later date for the account switch).

- Start using all the services provided by Urbo Bankas conveniently, and we will initiate the transfer of the specified payment services and account balance, as well as the closure of the account, upon your request.

Links

- Share

You can switch recurring transfers and account balances, as well as receive information on recurring receipts, e-invoice requests and e-invoice automatic debit transactions.

- Share

E-banking

You can find transaction limits that apply to your accounts in the Online Account Management Agreement or the Internet Bank (go to Settings -> Transaction limits). You can also find out the applicable limits by visiting your nearest bank branch.

You can change the transaction limits in the Internet Bank or via the mobile banking app. It is important to remember that due to the potential risk of fraud and the security of your funds, you can set the following maximum limits for payment transactions in the Internet Bank or mobile banking app:

- Single payment transaction limit – EUR 200,000;

- Daily payment transaction limit – EUR 200,000;

- Monthly payment transaction limit – EUR 2,000,000.

The limits changed in the Internet Bank or mobile banking app will not take effect until the following day. If you need transaction limits above the maximum or want them to take effect immediately, please visit your nearest branch.

- Share

If you are logging in with Smart-ID:

- Check that you have entered the correct User ID. You can find your User ID in your Agreement of Account Management by Internet.

- Make sure you enter the correct national ID number in the national ID number field. If you don’t have a national ID number, you can see the identification number you need to enter in the national ID number field in the Smart-ID app.

If you are logging in with Mobile-ID:

- Check that you have entered the correct User ID. You can find your User ID in your Online Account Management Agreement.

- Make sure you are using the correct telephone number and that the mobile signature service is provided to the telephone number you have provided.

- If you don’t remember your sPIN1 and sPIN2 codes, or if you have blocked them, you can find information on your mobile operator’s (Telia, Tele2, Bitė, Teledema) website.

If you are logging in with an SMS code:

- Check that you have entered the correct User ID. You can find your User ID in your Online Account Management Agreement.

- Make sure you have entered the correct password.

- If you enter incorrect details 4 times in a row, the system will automatically block you for a period of 30 minutes; if you enter incorrect details 8 times, your access to the Internet Bank will be permanently blocked.

- If you can’t remember your password, you can always try another means of logging in, such as Smart-ID or Mobile-ID.

- Share

If your access is temporarily blocked:

If you see the message: “Your access is temporarily blocked. Try again after XXX minutes”, it will be unblocked automatically after 30 minutes. Wait for the specified amount of time and try to log in again.

While you’re waiting:

- Make sure that you have the correct User ID. You can find your User ID in your Online Account Management Agreement.

- If you are logging in with an SMS code, please try to remember your password. If you can’t remember your password, try another means of logging in, such as Smart-ID or Mobile-ID.

- Please note that the maximum number of additional attempts (30 minutes apart) is 4. If you exceed the number of additional attempts allowed, your access will be automatically blocked.

If your access has been blocked:

If you see the message: “Your access is blocked.”, please call 19 300 or +370 52644800 (if you are abroad) for unblocking. Our call centre is open on weekdays from 8 a.m. to 5 p.m.

You can also visit your nearest Urbo Bankas branch. Make sure you have your ID card or passport with you.

- Share

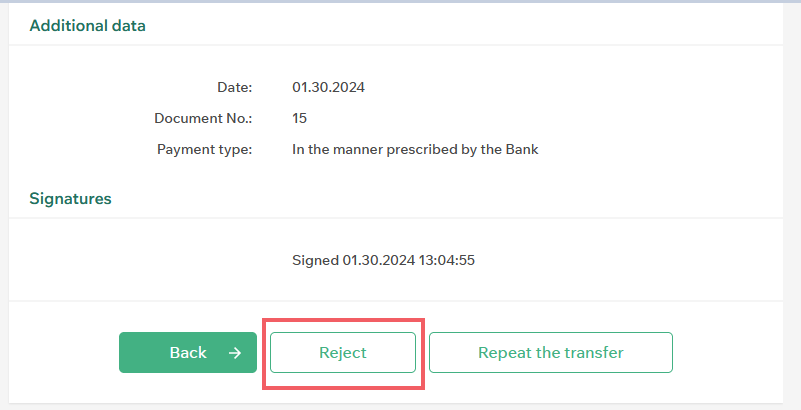

You can cancel pending payments by logging in to the Internet Banking and selecting the menu item Payments -> Payment overview and signing. Once you have found the payment you want to cancel, click on the text in the payment purpose field for that payment.

At the bottom of the payment review form that appears, click the Cancel button and confirm the cancellation by clicking the Yes button.

If the payment is successfully cancelled, the message Payment successfully cancelled will be displayed and the payment status will change to Cancelled.

- Share

If you notice that your account has not been debited or funds have not reached the recipient’s account, it is possible that your transfer has been rejected for some reason.

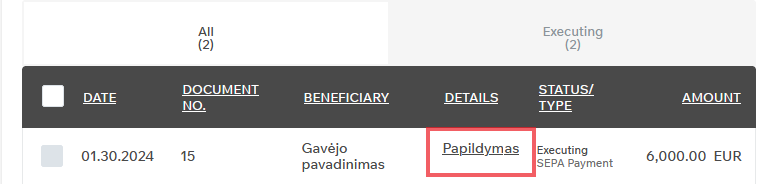

You can always check whether a transfer has been rejected and the reason for this by logging in to your Internet Bank, selecting Payments -> Payment overview and signing from the menu, finding the relevant payment and clicking on the text in the payment purpose field for that payment.

The reason for rejecting the payment will be provided at the bottom of the payment review form.

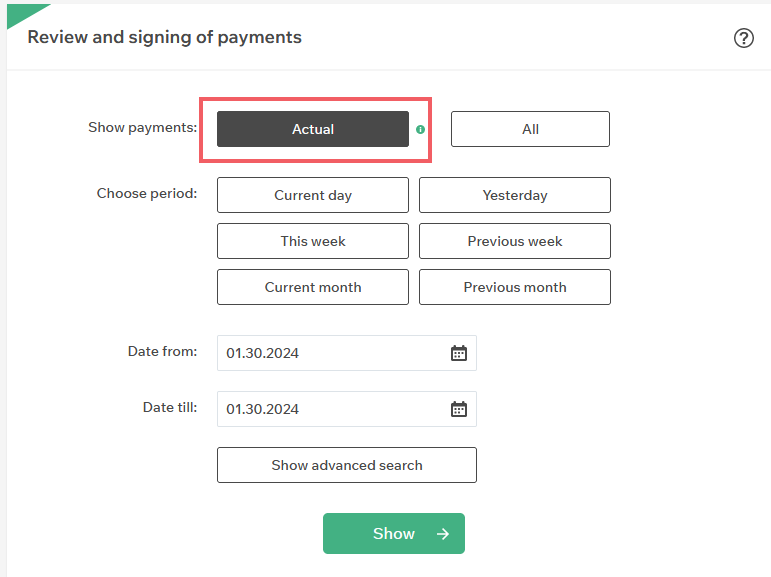

When searching for a transfer in the Payment overview and signing form, please note the available filters. If you choose to show only Current payments, the system will only show you today’s transfers. Select All to see transfers from the previous period.

- Share

The mobile banking app is a smartphone app for private and business customers of Urbo Bankas, which allows you to directly manage your finances with Urbo Bankas at any time using your smartphone.

The mobile banking app is available in Lithuanian, English and Russian.

Download the mobile banking app to your smartphone!

- Share

You can subscribe to the Notification Centre service in the Internet Bank of Urbo Bankas or mobile app:

- To subscribe, go to the "Settings" menu and select "Notification Center.";

- Depending on the method you choose for receiving notifications, please provide a telephone number, email address, or add a device to receive push notifications;

Important! If you want to receive push notifications, you must first log in to the bank’s mobile app and grant permission for the bank to send notifications. You can do this during your first login after downloading or updating the app from Google Play or the Apple Store. This will automatically add your device, and no further action will be needed.

If you did not grant permission for notifications during your first login, you can enable it later in your device settings. After granting permission, don't forget to register your device; - Choose how you want to be informed about messages from the bank. You can read the messages by logging in to online banking or the mobile app;

- Select how you want to be notified about changes in your account. Enter an amount—if exceeded or deducted from your account, you will receive a notification;

- Save your preferences.

- Share

It is likely that your device does not support the notification service used by Google Play Services. This may happen if your device is manufactured by a Chinese company that is subject to U.S. sanctions related to security and/or privacy violations.

It is important to note that even if your phone has the Google Play Store app and you can download the Urbo banking mobile app, notifications may still not be supported if your device is manufactured by one of the Chinese companies (such as Huawei, Redmi, Xiaomi, OnePlus, etc.) due to limited functionality of Google Play Services.

- Share

You can switch from your current SIM card to a special SIM card at your mobile operator’s store:

- “Tele2“

- “Pildyk“

- “Bitės Lietuva“

- “Telia“

- “Teledema“

- Share

To download your account statement, select Accounts and Account statement from the menu. Select the account and the period for which you would like to receive an account statement and click the Export button.

Once you have done this, select the format (XML, XLS, CSV or PDF) in which you would like to download your account statement and click the Save button.

- Share

Smart-ID uses two different identification numbers:

- PIN1 is used to log in to electronic services and to access accounts such as your bank account;

- PIN2 is for digital signatures, e.g., for banking transactions or signing a document.

The use of two PINs ensures the security of your Smart-ID. You can only use Smart-ID if you have your own smart device and know your two PINs.

- Share

Yes, you can use a Smart-ID Basic account created for you at other banks to log in to Urbo Bank’s Internet Bank or mobile banking app. If you are logging in for the first time with a Smart-ID Basic account set up at another bank, you will need to authenticate your identity by other means.

You can do so in the following ways:

- Log in to your Internet Bank with your Mobile-ID or SMS code and tick the consent box in your Smart-ID settings to allow you to use Smart-ID Basic account in the future for logging in or signing documents.

- Visit your nearest bank branch and ask a customer service employee to confirm the validity of your existing account (be sure to bring the smartphone with the Smart-ID app with your active account).

- Share

If you have not performed any actions in your Internet Bank or mobile banking app that require a PIN1 or PIN2 for confirmation, but you have received a notification on your device asking you to enter your PIN1 or PIN2, do not enter the requested PINs under any circumstances. Cancel the request and immediately inform the bank of the attempted access to your Internet Bank or mobile banking app using the contact details provided.

If you are using an iOS device, we recommend that you click on the appropriate button in the Smart-ID app, which will notify the service provider SK-Solution of the unauthorised request.

- Share

An account statement is a document that provides detailed information about all financial transactions conducted within an account (including commission fees and others).

A confirmation of online payment (payment order) is a document that provides information about a payment. If the document includes execution date of the transfer, ten the transfer can be considered executed.

- Share

You can find the confirmation of online payment document under Payments -> Payment overview and signing.

Locate the desired payment, click on its details, and then click on the printer icon. The document will be sent to your computer and prepared for printing.

Plase note that in the Urbo Internet Bank, you can only find confirmations for payments made through internet banking or the mobile application. If you made the transfer at a bank branch, the bank employee assisting you will ask you to sign, verify with their signature, and provide you with the payment order.

- Share

Payments

SEPA is the transfer of money from the customer’s account to another account at the instruction of the account provider. Transfers are made in Euro to accounts opened in SEPA countries. The SEPA (Single European Payment Area) countries are members of the EEA (the EU countries plus Iceland, Liechtenstein and Norway) and the United Kingdom, Switzerland, Andorra, Gibraltar, Monaco, San Marino, and the Vatican.

Non-SEPA is the transfer of money from the customer’s account to another account at the instruction of the account provider. Transfers are made in currencies other than the Euro or to the accounts opened in countries outside the SEPA.

- Share

- Intra-bank transfers, i.e., transfers of money between Urbo bank accounts (your own or those of other persons).

- SEPA payments, i.e., SEPA-compliant payments to the EEA (European Economic Area) countries (European Union, Norway, Iceland, Liechtenstein) and the United Kingdom, Switzerland, Andorra, Gibraltar, Monaco, San Marino, and the Vatican.

- SEPA instant payments (SEPA transfers up to EUR 100,000 are only made to banks/payment service intermediaries that are members of the SEPA Instant Payment Service (SEPA-INST) scheme).

- Recurring payments, i.e., regular ordinary SEPA payments made by the bank to the payee’s account at the customer’s instruction, in accordance with a chosen payment schedule.

- Payments for services, i.e., payments to service providers using a universal payment form (template).

The terms and conditions for the execution of payment orders are set out in the Payment Service Rules of the Bank and Transactions, and the information provided in the Payment Order Form.

- Share

Identification of the payer/recipient requires the name of the payer/recipient and the bank account number (international IBAN format)*.

* The bank credits the funds to the payment account according to the account number (IBAN) provided in the customer’s payment order and does not check whether the provided account number corresponds to the name of the holder of the account, so please make sure the recipient’s account number is correct every time!

- Share

Possible frequency of transfers:

- Specifying the day of the month (daily, certain selected days of the month);

- Specifying the weeks of the month (weekly, every day of the week, certain days of the week);

- Specifying the months of the year (monthly, every other month, quarterly, specific months).

The following debiting can be selected as a recurring payment:

- Fixed amount;

- Full balance on the account;

- Any amount in excess of the specified minimum balance that must remain in the account after the transfer has been completed;

- Part of the amount, expressed as a percentage, to be debited from the balance on the account.

A recurring payment transaction can only be terminated on the day you request cancellation of the recurring payments.

There is no possibility to make an advance request for cancellation of recurring payments at a future date of your choice.

- Share

The terms and conditions for the execution of international payment orders* are set out in the Payment Service Rules of the Bank, the Price List of Services and Transactions, and the information provided in the Payment Order Form.

- Share

Anti-money laundering, counter-terrorist financing, anti-fraud and international sanctions and restrictive measures in place at Urbo Bankas include enhanced monitoring of payment transactions. Enhanced monitoring of payment transactions is carried out by suspending outgoing or incoming payments and checking the documents supporting the payment transactions. Please note that in all cases, payments sent to or received from high-risk regions are suspended. The following are considered high-risk regions:

- Countries subject to enhanced monitoring by the Financial Action Task Force (FATF) (Turkey, United Arab Emirates, etc., see list of countries);

- Countries on the European Commission’s list of high-risk countries (paragraph 1, Annex 1 to Regulation (EU) 2016/1675 – Afghanistan, Philippines, Morocco, Pakistan, etc., see list of countries);

- Countries included in the list of target territories approved by the Ministry of Finance of the Republic of Lithuania (Order No. 344 of 29/12/2001, see list of countries);

- Russia and Belarus – due to the international sanctions imposed on these countries, we recommend that you do not make payments to Russia and Belarus; for more detailed information on the sanctions and payment restrictions imposed on these countries, see the FAQs on payments with Belarus, Russia;

- Other countries of the Commonwealth of Independent States (Azerbaijan, Armenia, Kazakhstan, Kyrgyzstan, Moldova, Tajikistan, Turkmenistan, Uzbekistan), due to the high risk of circumventing international sanctions against Russia and Belarus.

The documents normally requested to support the transaction include contracts, VAT invoices and, in the case of supplies or transport, bills of lading, customs declarations and certificates of origin. You may also be asked to provide additional documentation, such as registration documents revealing the identity of the private persons (beneficial owners) controlling the business partner, in order to verify that the customer’s business partner is not subject to international sanctions or restrictive measures.In cases where the risk of a payment transaction is determined to be unacceptable to Urbo Bankas, or where the customer does not provide all the documents necessary for the risk assessment of the payment transaction, Urbo Bankas may refuse to execute or credit the payment.

- Share

Money transfers are a way to quickly transfer money to a recipient’s account anywhere in the world without having to open a bank account (e.g., people working abroad can transfer money to their relatives in their home country, while those living in Lithuania can transfer money to people abroad).

Ria was founded in 1987 and is today the third largest money transfer company in the world. The company offers fast, reliable and secure money transfer services. Ria’s mission is to be the most advanced money transfer company in the world, offering top-quality, competitive and reliable payment services to its customers.

Ria operates in 146 countries around the world and has over 300,000 service points worldwide.

- Share

MoneyGram was founded in 1940 and is the second largest money transfer company in the world. MoneyGram is a global and innovative money transfer service provider and a well-known worldwide financial intermediary between friends and family.

MoneyGram operates in over 200 countries around the world and has over 350,000 service points worldwide.

- Share

- A bank account is not required for sending and receiving money;

- The service is only available to persons who have reached the age of legal majority.

- The bank pays out MoneyGram transfers in euros. If the money is sent in a different currency, MoneyGram carries out the conversion and the preliminary exchange rate is indicated to the sender at the time of entering the transfer.

- The bank pays out Ria transfers in euros (EUR) and British Pounds Sterling (GBP).

- Urbo Bankas executes Ria and MoneyGram transfers in EUR, but other currencies may be used if you wish and if the recipient’s country supports such currencies. In this case, the amount to be sent will be calculated in euros.

- Share

The bank accepts bearer cheques in euros (EUR) and British Pounds Sterling (GBP). The Bank accepts cheques issued by the EU (except Greece, Austria), British, Norwegian and Canadian banks.

- Share

The cheque must be presented for cashing less than 5 months after the date of issue. When the cheque is cashed, the amount indicated on the cheque, after deduction of bank fees for cashing the cheque, will be transferred to the Urbo Bankas account specified by you.

- Share

It is an electronic version of a VAT invoice sent to the recipient (payer), i.e., directly to the Urbo Bank customer’s online bank account.

- Share

With an Automatic E-Invoice Payment Agreement, you can make insurance or lease payments, pay for utilities, Internet and phone connection, and other services (gym memberships, subscriptions to publications, etc.).

- Share

When entering into an Automatic E-Invoice Payment Agreement, you can choose:

-

The invoice payment date;

-

Maximum limits for invoice payments.

- Share

You can subscribe to e-invoices from the following service providers. E-invoices from service providers that are not on the list can only be subscribed to directly with the service provider.

Service prociders:

2 EUROPE, UAB

4FINANCE, UAB

ACTIVE VILNIUS/ FABIJONIŠKIŲ BASEINAS, VŠĮ

ACTIVE VILNIUS/ LAZDYNŲ BASEINAS, VŠĮ

ALYTAUS MIESTO SAVIVALDYBĖS ADMINISTRACIJA

ALYTAUS REGIONO ATLIEKŲ TVARKYMO CENTRAS, UAB

ALYTAUS ŠILUMOS TINKLAI, UAB

ASHBURN INTERNATIONAL, UAB

ASMENYBĖS UGDYMO KULTŪROS CENTRAS, VŠĮ*NARIO MOKESTIS

ASOCIACIJA RAUDONOS NOSYS GYDYTOJAI KLOUNAI

AS GO3 BALTICS (GO3)

ATLETO SPORTO PROJEKTAI, VŠĮ

AUKŠTAITIJOS VANDENYS

AUROJA/ SPORTO KLUBO EOLA ABONEMENTAS, UAB

AVIVA LIETUVA, UAGDPB

BALTERMA SYSTEMS, UAB

BALTIC EMPLOYMENT SOLUTIONS, UAB

BALTICUM TV, UAB

BERENDSEN TEXTILE SERVICE, UAB

BITĖ LIETUVA, UAB

BLENDER LITHUANIA F1, UAB

BLENDER LITHUANIA, UAB

BRINKS LITHUANIA, UAB

BTA BALTIC INSURANCE COMPANY FILIALAS LIETUVOJE

BUTŲ ŪKIO VALDOS, USB BUV MOKĖJIMO PRANEŠIMAS

CASTRADE SERVICE, UAB

CGATES, UAB

CIRCLE K LIETUVA, UAB

CITY BOXING SPORTO KLUBO NARYSTĖ

COMPENSA LIFE VIENNA INSURANCE SE

COMPENSA VIENNA INSURANCE GROUP ADB

CSC TELECOM, UAB

DEBRECENO VALDA, UAB

DINETAS, UAB

DZŪKIJOS VANDENYS, UAB

ECOFON, UAB

ECOSERVICE PROJEKTAI, UAB

ECOSERVICE, UAB

EGA LT UAB

EKSKOMISARŲ BIURAS, UAB

ELEKTA, UAB

ELEKTRONINIŲ MOKĖJIMŲ AGENTŪRA, UAB

ELEKTRUM LIETUVA, UAB

ELIS TEXTILE SERVICE, UAB

ENEFIT, UAB

ENERGIJOS SKIRSTYMO OPERATORIUS, AB

EOLA PLIUS, VŠĮ

EOLA, UAB

ETANETAS, UAB

EUROCASH1, UAB

EUROCOM, UAB

EVATECHAS MB

FABETA, UAB

FANKAS, UAB

G4S CASH SOLUTIONS, UAB

G4S LIETUVA, UAB

GARANT, UAB

GELSVA, UAB

GF BANKAS, UAB

GYM PLIUS, UAB

GYVYBĖS DRAUDIMO UAB SB DRAUDIMAS

GJENSIDIGE, ADB

GOINDEX PASAULIO AKCIJŲ FONDAS

GOINDEX SUBALANSUOTAS FONDAS

GREN LIETUVA, UAB

GRIFS AG, UAB

GSM APSAUGA, UAB

HERKAUS KLUBAS, UAB

IF P&C INSURANCE AS FILIALAS

IGNITIS

IMPULS LTU, UAB

INBANK FILIALAS, AS

INIT, UAB

INSERVIS, UAB

INVL X SB DRAUDIMAS DRAUDIMO ĮMOKA

INVL X ŠIAULIŲ BANKO III PAKOPOS FONDAS

JURITA, UAB

KAUNO ARENA (UŽ BASEINO NARYSTĘ), UAB

KAUNO ŠVARA

KAUNO VANDENYS, UAB

KAVAMEDIA, UAB

KILO GRUPĖ, UAB

KLAIPĖDOS BASEINAS, UAB

KLAIPĖDOS ENERGIJA, AB

KLAIPĖDOS VANDUO, AB

KOPA GYM UŽ SUTEIKTAS PASLAUGAS

KRETINGOS BŪSTAS

KRETINGOS VANDENYS, UAB

KUPIŠKIO BASEINAS_ EINAMOJO MĖNESIO SĄSKAITA UŽ SPORTO IR SVEIKATINGUMO CENTRO NARYSTĘ

L-2002 891-OJI INDIVIDUALIŲ GYVENAMŲJŲ NAMŲ STATYBOS BENDRIJA

LANSNETA, UAB

LEMON GYM (UAB GYM LT)

LIETUVOS DRAUDIMAS, AB

LIETUVOS NACIONALINIS UNICEF KOMITETAS ASOCIACIJA

LIETUVOS PROFESINĖ SĄJUNGA SANDRAUGA

LINDE GAS UAB

LITESKO FIL.MARIJAMPOLĖS ŠILUMA, UAB

LITESKO FILIALAS ALYTAUS ENERGIJA, UAB

LITESKO FILIALAS BIRŽŲ ŠILUMA, UAB

LITESKO FILIALAS DRUSKININKŲ ŠILUMA, UAB

LITESKO FILIALAS KELMĖS ŠILUMA, UAB

LITESKO FILIALAS PALANGOS ŠILUMA, UAB

LITESKO FILIALAS TELŠIŲ ŠILUMA, UAB

LITESKO FILIALAS VILKAVIŠKIO ŠILUMA, UAB

LK SERVICE, UAB

LPF SOS VAIKŲ KAIMAI

LUKOIL BALTIJA, UAB

LUMINOR LIZINGAS, UAB

M7 PLIUS, UAB

MALTOS ORDINO PAGALBOS TARNYBA

MANDATUM LIFE INSURANCE COMPANY LIMITED LIETUVOS FILIALAS

MEMBAS, UAB

METLIFE T.U.Z.R.S.A

MOKESTIS UŽ OXYGYM MĖNESINĘ NARYSTĘ

MOKILIZINGAS, AB

MŪSŲ SPORTAS, UAB

NERINGOS VANDUO, UAB

NESTE LIETUVA, UAB

NOVITI, UAB

ODONTOLOGIJOS KLINIKA AMICUS DENTIS, UAB

OMNIVA LT UAB

PALANGOS BASEINO SPORTO KLUBO NARIO MOKESTIS(UAB HIDRANA)

PANEVĖŽIO BUTŲ ŪKIS, AB

PANEVĖŽIO ENERGIJA, AB

PARAMOS FONDAS GERŲ DARBŲ DIRBTUVĖ

PERLAS ENERGIJA (ELEKTRA)

PLAUKIMO KLUBAS, VŠĮ

PRAKTIŠKAS, UAB

PRIEMIESTIS, UAB

PROGMERA, UAB

PUŠŲ TERASOS, DGNSB

PZU LIETUVA GYVYBĖS DRAUDIMAS, UAB

RADIJO ELEKTRONINĖS SISTEMOS, UAB

ROBOLABS, UAB

ROKIŠKIO KOMUNALININKAS, AB

ROKIŠKIO VANDENYS, UAB

SANTAROS KLINIKŲ GYDYTOJŲ SĄJUNGA

SAUGOS TARNYBA ARGUS, UAB

SAVICKO SPORTO KLUBAS, UAB

SB LIZINGAS UAB

SEB GYVYBĖS DRAUDIMAS, AB

SEB LIFE AND PENSION BALTIC SE LIETUVOS FILIALAS

SEESAM INSURANCE AS LIETUVOS FILIALAS

SĮ KRETINGOS KOMUNALININKAS

SĮ VILNIAUS ATLIEKŲ SISTEMOS ADMINISTRATORIUS

SIA CITADELE LEASING LIETUVOS FILIALAS

SIA UNICREDIT LEASING LIETUVOS FILIALAS

SIGRETA, UAB

SOS VAIKŲ KAIMŲ LIETUVOJE DRAUGIJA

SPLIUS, UAB

SPORTO INFRASTRUKTŪRA, UAB

SPORTO KLUBAS BUDORA

SPORTO KLUBAS - PRIKLAUSOMI NUO SPORTO

SPORTO KLUBŲ SISTEMA, UAB

SPORTO REALISTAI, UAB

STOVA, UAB

SVEIKIEJI BALTAI, UAB

SWEDBANK P&C INSURANCE AS LIETUVOS FILIALAS

SWIFT ARENA UŽ SUTEIKTAS PASLAUGAS

SWIMCADEMY PLAUKIMO AKADEMIJA

ŠIAULIŲ VANDENYS, UAB

TAVO SPORTO AKADEMIJA, UAB

TELE2, UAB

TELEDEMA, UAB

TELIA NAMŲ/IT IR BIURO PASLAUGOS

THE MUSCLE MAKERS, UAB

TRAKŲ RAJ. KĮK, UAB

TRAKŲ ŠILUMOS TINKLAI, UAB

TRENIRUOČIŲ PASAULIS, UAB

TV PLAY BALTICS (HOME3), AS

VAIKO RAIDOS KLINIKA

VERKIŲ BŪSTAS, UAB

VERSLO TILTAS, UAB

VILKAVIŠKIO ŠILUMOS TINKLAI, UAB

VILNIAUS ŠILUMOS TINKLAI, AB

VILNIAUS VANDENYS, UAB

VITĖS VALDOS, UAB

VO GELBĖKIT VAIKUS

VSA VILNIUS, UAB

ŽALGIRIO PLAUKIMO AKADEMIJA

- Share

Currency exchange

Service plans

A service plan is a bundle of services for a customer (natural person) offered for a fixed monthly fee.

- Share

The service plan is valid indefinitely until you terminate the subscription. However, the bank has the right to terminate the service plan subscription by sending a notice to the customer in cases where:

- The customer does not comply with the terms and conditions of the payment services.

- The bank no longer offers the service plan or any service included in it.

- Share

- The customer must notify the bank in writing 30 calendar days in advance of termination of the service plan.

- You can change your service plan free of charge once per calendar month.

- If you terminate or change your service plan before the end of a calendar month, the monthly fee for the plan will be applied in proportion to the number of calendar days the plan was active. The fee is debited by the 10th of the following month.

- Share

Yes, but when a non-resident natural person subscribes to the service plan, a minimum fee for basic banking services is charged in addition to the plan fee.

- Share

Payment cards

You can withdraw cash from all ATMs marked with the VISA logo. The withdrawal fee depends on the service plan you choose.

- Share

Once you’ve ordered your card, you will be able to start using it for online payments within 1 hour of ordering. To pay using a plastic card, you are always asked to insert it into the card reader and enter the PIN, which will only be visible in your Urbo online bank or mobile app.

- Share

You can block your payment card at any time in the Internet Bank or mobile app. You can call 19300 or +370 5 264 4800 (when calling from abroad) during the Bank’s opening hours.

- Share

Submit a free-form, signed notification in the Internet Bank, stating the time, amount of the disputed transaction and the merchant’s name. If you suspect that your card details have been compromised, block your card immediately.

- Share

The card will work in all countries and in any currency supported by VISA. Even though your card is in euros, the amount will be automatically converted at the time of payment.

- Share